This means you have a debt ratio of 37.5. Your calculation would be as follows: 1500/4000 37.5. Co-borrowers may only be the lawfully wed spouse of the veteran borrower, including same-gender marriages that were performed in states where such marriages are legal or Oregon Registered Domestic Partners. For example, let’s say your monthly gross income equals 4,000.

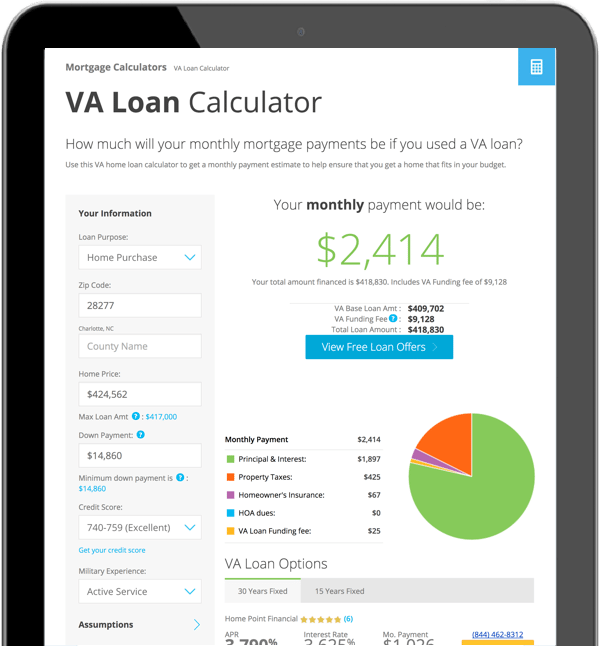

No income limitations other than evidence of capacity to repay loan.s calculator takes into account variables specific to VA loans. Four (4) loan maximum lifetime benefit (only one loan may be open at the same time). Use our VA mortgage calculator to determine your monthly payments with a VA loan.Occupancy must occur within 60 days of closing.Qualifying property types: Site built single family homes, condos, townhomes and manufactured homes affixed to land and taxed as real estate located within Oregon.

Owner-occupied primary single-family residence.Property must be located within the state of Oregon however, veteran borrowers are not required to be an Oregon resident upon application.This is different from federal VA Home Loan Guaranty eligibility. Veterans who have established their eligibility with ODVA may apply. This VA mortgage calculator gives you a look at your estimated monthly payment using a VA Purchase or VA Refinance Loan.Private mortgage insurance is required for all loans in excess of 80% LTV.ODVA loans are underwritten to conventional conforming FNMA guidelines.ODVA Loans are conventional loans and are not affiliated with the federal VA Home Loan Guaranty.Up to four (4) home loan maximum life benefitĪdditional ODVA Home Loan program requirements mentioned below are general in nature and are not to be construed as the final authority on eligibility or lending decisions.Purchase only (no refinancing is available).Owner-occupied, single-family residence.This Oregon benefit is separate and distinct from the federal VA Home Loan Guaranty and has lent Oregonians approximately $8 billion of low-interest home loans to more than 334,000 veterans.Ĭurrently, the home loan program offers eligible veterans fixed-rate financing for: Since 1945, Oregon is one of only five states in the nation that offers a state home loan to veterans. Please contact us at 1-80 or 50 for potential assistance options. If COVID-19 has impacted your ability to make your mortgage payment, we're here to help. If the home you are buying is more than your remaining entitlement allows, you can still use a VA loan if you put down 25% of the difference of the purchase price and maximum loan amount.COVID-19 update: The Oregon Department of Veterans' Affairs is committed to supporting our veteran home loan borrowers and being a source of assistance in this time of uncertainty.

#Va loan calc mac

VA uses conforming loan limits established for Fannie Mae and Freddie Mac to determine maximum VA loan eligibility when there is entitlement in use that will not be restored. Your new VA loan must be on an owner occupied primary residence. Use the VA entitlement worksheet to calculate your maximum VA loan amount. So yes, you can have more than one VA loan. Veterans borrowers with deferred student loans are exempt from student loans being counted in debt to income ratio calculations. However, student loans need to be deferred for at least 12 months. However, if you have entitlement in use that will not be restored, your new VA loan must still be over $144,000, and the Freddie Mac county loan limit will factor. VA Loans is the only mortgage loan program that exempts student loans that are deferred from DTI Calculations. Simply enter your loan amount, terms, interest rate, and start date. Calculate the maintenance and utility costs by multiplying the home’s total square footage by 0.14, which gives you that number for the VA’s loan analysis. Use Bankrates VA loan calculator to find out what your monthly loan payments would be. When a home's purchase price exceeded the county loan limit in the past, a VA homebuyer would have been required to make a down payment. The standard rate for the VA is 14-cents-per-square-foot. Previously, VA homebuyers were limited to the corresponding county conforming loan limit when purchasing a home with 100% financing. The VA has eliminated county loan limits effective January 1, 2020. If you have no outstanding entitlement, there is no longer a loan limit imposed by the VA. Calculate Maximum VA Loan Amount & Tier 2 VA Entitlement 2020 VA Loan Limit Changes

0 kommentar(er)

0 kommentar(er)